The Importance of Good Credit for Real Estate

What is a good credit score for a mortgage and how do I check mine?

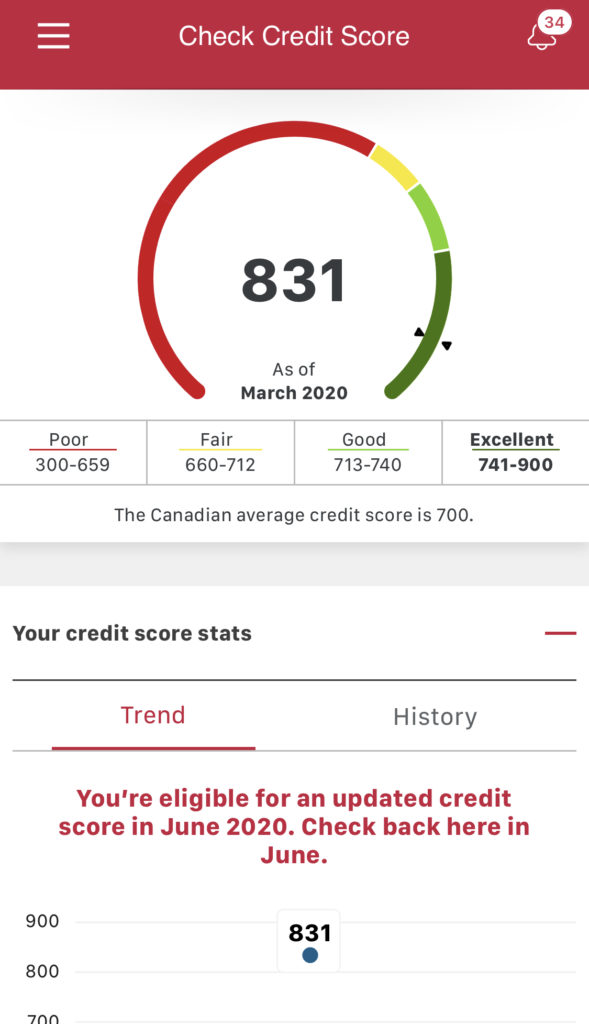

There are a number of steps to getting mortgage financing. A particularly important step, and one many people don’t give much thought to, is the credit check. As a routine part of the application process the lender will order a copy of your credit history. The higher your credit score is the more favourable the lender will view your application.

Learn here about getting and understanding your credit report from credit reporting agencies by the Financial Consumer Agency of Canada.

Your personal credit history is compiled by credit reporting agencies, which collect information from various sources including banks, retailers and other public records, creating a credit report. Information such as: what credit and debit cards you have, the types of accounts you have at various financial institutions, information about personal loans, mortgages, student loans, etc., is all part of the report.

The Credit Report

The report shows the creditors’ names, account numbers, the date accounts were started, the current balance as well as a detailed payment history (for example: how many times you were over 30, 60, or 90 days late in paying bills).

Generally, credit reports show information going back six to seven years. The report will also show public information, for example, marriages, divorces, liens, judgments that have been entered against you, bankruptcies, etc.

The credit reporting agenciy provides information on your credit history to mortgage companies and banks.. The lender will examine the credit report to aid in determining whether to lend you money. If the lender has any concerns about something on the report the lender may ask you for an explanation. A good credit score for a mortgage is a minimum of 620.

Though lenders usually work as quickly as possible in processing mortgage applications – the process can be slowed down if the lender needs to go back to the applicant for an explanation concerning items on a credit history. So, don’t worry, but be prepared to answer questions the lender may have – often a simple explanation will do.

Other information included on your Credit Report

The lender will also use the report to verify other information on your mortgage application, for example: information about your employment status, your address (including the name of your landlord and perhaps rental payment history), etc. The credit report will also indicate inquiries made by other creditors over the period of the report.

This information might be useful to a lender to show what other avenues of financing you might have tried and it may raise questions about why another potential creditor declined to lend it to you.

Honesty is the best policy – and that certainly holds true when applying for a mortgage. If you think there might be any credit problems – tell the lender up front and ask about the lender’s policy prior to applying for the mortgage.

There is no point in trying to hide something that will show up in your credit history. Of course, even if you think your credit record is fine, there may be detrimental comments on the report about which the lender may ask you.

Just like the old saying – a stitch in time saves nine – by getting a copy of your credit report before you apply for a mortgage you may be able to avoid surprises and possible delays that may occur in having to answer questions about your credit report.

Because the report contains information about you, you have a right to inspect a copy of it. Equifax, one of Canada’s largest credit bureaus, will mail consumers a free copy of their personal credit file upon request. The request must be by mail or via fax, and certain information must be supplied with the request. For more information, call Equifax at 1-800-465-7166.

Incorrect Credit Report

If you disagree with something in your credit history you have the right to challenge it, and you can ask for the information to be corrected. For example, perhaps the report shows that you were over 90 days late paying a bill but the report does not indicate that you withheld payment pending a settlement of a dispute with the creditor. Or perhaps you were late with a particular payment because you were away or the bill was lost in the mail.

Whatever the explanation, contact the credit bureau to attempt to clarify the matter and have the file corrected. Equifax, for example, ensures that file correction procedures to personal credit files are made within seven days, and they send amended copies of your history to any company that has received your credit report in recent months.

Now that you know the importance of a good credit for Real Estate and the credit report for your mortgage application you can take your first steps towards the purchase of your property. Now go to this link to learn what can you actually afford? with a good credit score for a mortgage.

SEAN ROGGEMAN

250-341-5445

sean@rockieswest.com

INVERMERE REAL

ESTATE OFFICE

492 Highway 93/95

Invermere, BC V0A 1K2

FAIRMONT REAL

ESTATE OFFICE

#3, 5019 Fairmont Resort Rd

Fairmont Hot Springs

BC VOB 1L1